[Download] Put More Cash In Your Pocket And Delete Credit Card Debt

If you want to make cash you first have to understand the flow of it first. You see, money attracts money… the more you have of it, the more that comes your way.

I see so many people looking for the latest quick fix or the ultimate magic pill that will take away all their financial pain.

Well, I’m here to tell you that if you don’t have your own personal finances in order then making more money is only going to make your situation worse.

Making More Money Is NOT The Answer

You read correctly… if you are struggling financially, more money is NOT the answer to your problem!

I'm pulling back the curtain, revealing my best kept Deal Finding Secrets!

- My Secret Search Strategies: Unlock hidden cracker deals no one else knows about

- Stop wasting hours on research: Simple setup automatically hunts down hot deals for you!

- How to use Australia’s top research tool anytime to turning boring research into an exciting treasure hunt

- Bonus: Free Research Tool Credits Included!

🎯 Don’t miss this!

The good news is you have the power to control your own finances and I’m going to show you how.

Now I’m not going to use the word ‘budgeting’ here because most people run a mile when they hear that word… so stay with me here.

The key to successfully managing your cash flow is simple: don’t spend more than you earn… sounds simple, right?

So why do so many people struggle with having money to pay their bills at the end of the month? Why is credit such a problem in this country?

I put it down to the ‘must have it now’ mentality or impulse buying. I can tell you that on occasion that I’m guilty of it but we all know that retail therapy is very short lived and never quite satisfies the need we are trying to meet.

In a credit focused society, it’s not hard to see where people go wrong:

- 60 months interest-free TVs and leather couches

- 1% car loans

- Swipe now, pay later

It’s all based around having the item before you can afford it. In other words, paying for the goods you want to have now with tomorrow’s income.

The Real Problem

Tomorrow’s money isn’t in your bank account yet which means you are constantly handcuffed to your job that provides a wage to pay the monthly credit card repayments.

What’s more, it’s even worse when you use tomorrow’s income to pay for a depreciating asset.

I can remember many years ago when credit was readily accessible to anyone that wanted it and lending institutions were flogging the term ‘Equity Mate’… if you don’t remember or weren’t around during this time, let me refresh your memory.

Banks were encouraging their customers to start accessing the equity (current value of their investment property minus the debt owed to the bank) in their property so they could buy luxury items (a new boat, a new car or an overseas holiday).

The theory was if you had bought an investment property for say, $50,000 back in the 1980’s and the property market had lifted the value of that property or you had paid down enough debt, you might have had another $100,000 in equity available to access.

There were four problems with this:

- In borrowing the extra available funds that was built up during the period of owning the property, you now had a larger debt to pay back (erasing any ‘buffer’ you had already created).

- It also meant you had higher interest repayments each month (to pay for the luxury item) which meant you needed to come up with more cash each month to cover the costs of the loan.

- The luxury item purchased with the equity was generally a depreciating asset, meaning it would decrease in value over time (driving a new car off the lot generally means you lose 20% in value instantly and that value continues to drop with time, meaning you can never sell it to repay all the debt).

- You are now more exposed to the chance of experiencing every investor’s nightmare… negative equity (where the market drops and reduces the value of your asset to less than the debt owed… and the bank comes knocking on your door for the difference!).

It’s not a pleasant scenario, especially for those that were enticed by the opportunity to have it now and pay for it with tomorrow’s income.

So how do you avoid ending up in such a sticky scenario?

Well in the words of Benjamin Franklin;

If you know how to spend less than you get, you have the philosopher’s stone.

In simpler terms, Mr. Franklin was saying, spend less than you earn… and that’s the key to managing cash flow, which ultimately, is the beginning of a successful property investor.

How To Turn Your Finances Around Using My (Free) Cash Flow Planner

Ok so now you have the concept (which isn’t that hard to get your head around), let’s talk about implementation.

To do that, I want to give you a unique resource of mine… it’s a tool I’ve been refining, perfecting and applying for over 10 years.

It’s my cash flow planner and you can download it by clicking here now:

Download The Cashflow Planner

I’ve been perfecting (and applying) the Cashflow Planner for over 10 years… and now it’s yours for free! Click on the link below to download this great resource now (no opt-in required.)

Now don’t get me wrong, this is not some mystic resource that will magically provide you with surplus cash every month… you actually have to do some work here. But in my experience, I’ve found that financial success is directly related to the amount of effort and commitment you contribute to managing your own spending habits.

What a perfect time to make that commitment and create some long lasting habits that will in turn create some lifelong financial benefits.

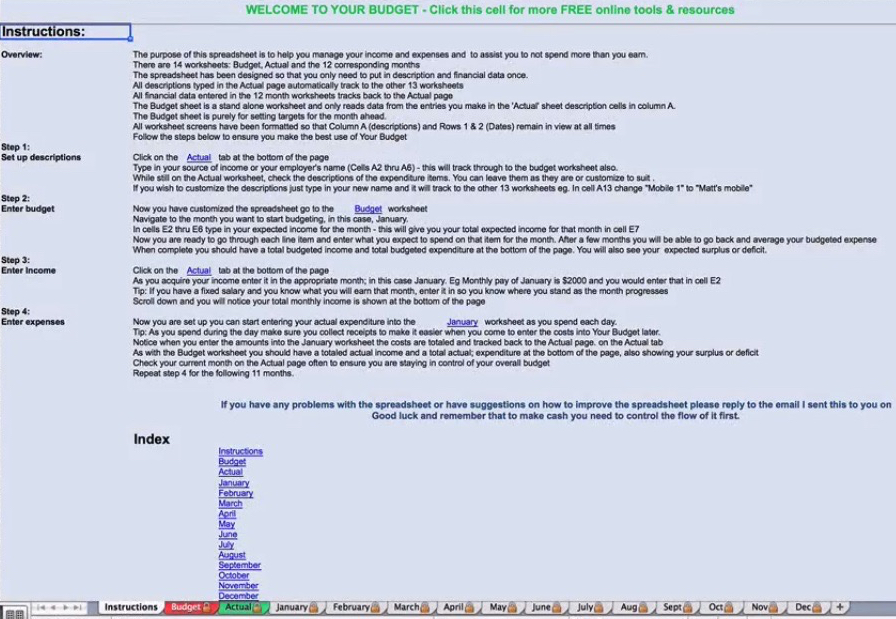

Cashflow Planner Instructions

Now that you’ve downloaded the Cashflow Planner, click ‘Play’ on the video below for a quick tour around this great tool (or read the text version of the instructions below instead):

After you’ve downloaded the Cashflow Planner, the first page you’ll see is an ‘Instructions’ sheet. This page will provide a reference to you as you work to utilize the planner successfully.

At the bottom of the Cashflow Planner, you’ll see several other tabs after the Instructions tab:

- The ‘Budget’ tab

- The ‘Actual’ tab

- 12 additional tabs (one for each month of the year)

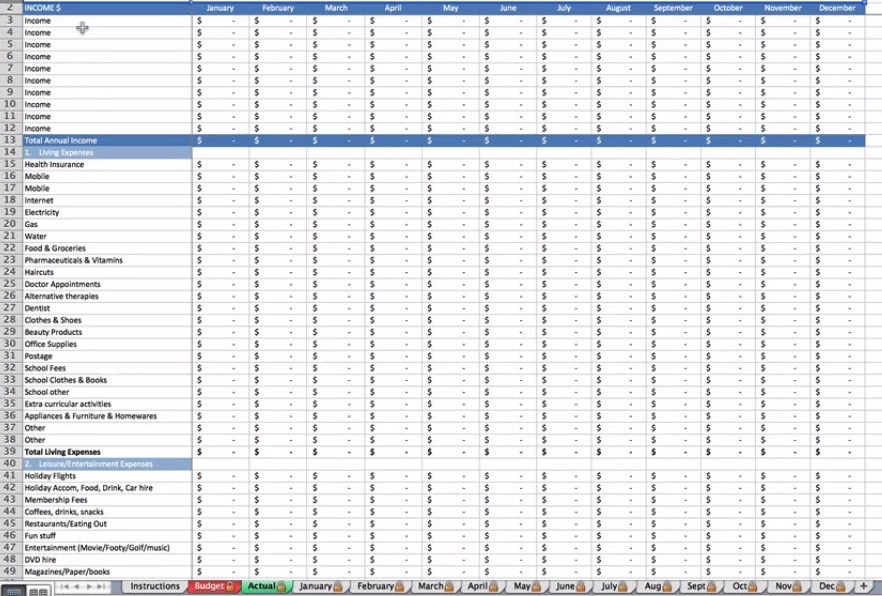

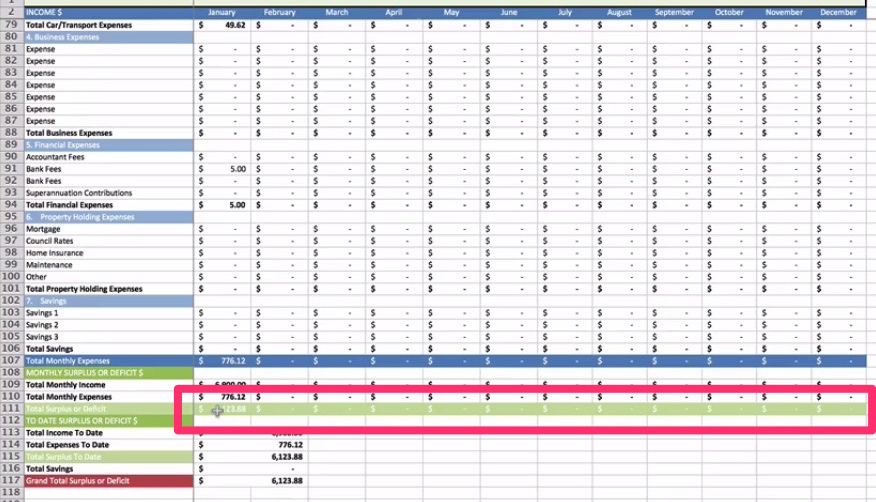

The main tab you’ll want to focus on is the ‘Actual’ tab:

This tab lists all income and expense categories that you may have. It’s important to note that all information added to the ‘Actual’ tab transfers to each monthly tab.

In the ‘Actual tab, you’ll list all sources of income and all expense categories, such as electricity, housing costs and other expense items.

From there, you’ll proceed to the current month’s tab. You’ll see that each monthly tab has a column for every day within the month. The daily tabs for each month are where you will track your daily expenses for the month.

As you enter each expense on the day of the month you spend it, all totals will track back to the ‘Actual’ tab, where you can analyze your monthly income vs. your monthly expenses for each month.

The ending monthly surplus or deficit also tracks to the following month, so that you understand exactly how much money you’re starting the next month with. This big picture view of your finances will assist you in gaining a clearer understanding of where you’re at financially, and from there you can adjust spending as necessary.

The budget tab is a stand-alone tab that exists as a means for you to estimate how much you’ll spend each month and compare it with your actual spending. With the ‘Budget’ tab, your left column titles will transfer from the ‘Actual’ tab, but the monetary columns will stay blank until you enter your estimated budget amounts for each month. Once you begin to have an idea of what you need and want to spend each month, you can create ‘target’ spending numbers via the ‘Budget’ tab, which will assist you in reaching your spending goals.

Once you begin using this system and creating a cash surplus, it’s amazing how quickly cash accumulates, which then builds confidence in that you do indeed have the ability to save and manage your own money. From there, you have the building blocks you need to begin growing and creating wealth.

Download The Cashflow Planner

I’ve been perfecting (and applying) the Cashflow Planner for over 10 years… and now it’s yours for free! Click on the link below to download this great resource now (no opt-in required.)

Looking for proven ways to create profits in the current market?

You'll find over 200 step-by-step case project studies, our renown Master Classes and Property Crash Courses… and heaps more!

Try the Ultimate Property Hub now –– it's free!

Hi Matt, I do not normally do budgets (did it once kept every receipt and accounted for everything etc…) but then realized I don’t really waste money anyway, life was very uncomplicated back then, we are going back just a few years, lol.

Last year I started to focus heavily on cashflow tracking it “No” just allowing for it (Expenses etc…) Basically I worked out how much I needed to put aside every week and I put that amount plus a bit extra into a separate account for my expenses etc…

I do not want to focus on my expenses, so now I pay all expenses from that account and I don’t need to worry where if I have enough money to pay for it or juggle things just to get through, I just want to focus on my cash flow now 🙂

Thanks for the comments Daryl. Yes i totally agree…. having a separate account for expenses is a great idea and takes the worry out of making sure you have enough each month.

I even setup a couple of extra expense accounts with a separate bank (ING has no fees) so its difficult to pull the money out for day to day expenses. That way i have a buffer in case there is an unexpected expense like the car breaking down or needing a new fridge. By keeping it in a separate account it takes a day or so to transfer it back to withdraw which always makes me thing first before i do it 🙂

Good stuff Daryl!

Thanks for the great advice Matt. I downloaded the Cashflow Planner and am looking forward to putting it into practice!

Thanks for the feedback Jade. Its a great time of year to start putting good habits in place. Good luck and let me know how you go!

Hi Matt,

I usually spreadsheet our finances with block amounts set aside for each category on a weeky basis. I thought this was working okay….until I had a go of your budget tool. I’ve used it for only 1 week, and I’ve noticed that I’ve had a huge shift in the way I think about our spending habits. Previously I would just go through the credit card bill at the end of the month and allocate the weekly spend. Then just mentally note the areas where we needed to monitor. What I’ve found at the end of this week, is that I have far more clarity on where our money goes. I now think more about each purchase more before I do it. I see myself popping the spend into your spreadsheet and it makes me think of whether it is totally necessary or not. Also, the pressure of feeling like we need to make more money can sometimes feel helpless. Whereas, with your daily budget tool, I’m realising that we don’t necessarily need to make more money, rather, just not spray our money here there and everywhere….I feel like I am earning money now by not spending it so freely….and as a new stay-at-home mum, I feel like I am contributing to the financial freedom of our family….by really being on top of our finances.

The extra accounts with ING are a fantastic suggestion too, and that is the next thing on the list of my ‘financial spring clean’.

So, thank you for offering the free download Matt….it’s helped this sleep deprived mum get some much needed financial clarity.

Marnie

Hi Marnie. Thanks so much for the great feedback and giving us an insight into how the Cashflow Planner has changed the way you manage your finances. Its so inspiring to hear others use the information to make massive change in their lives and you sharing your circumstance has inspired me and Im sure many others to improve our spending habits. Thanks again and I hear you with the sleep deprivation 🙂

Hi Matt,

Great article, so very true. As a mortgage broker I get to see a lot of different clients in different situations. It troubles me when I see first home buyers desperate to get into their first home but sabotaging themselves by prioritising things like cars, toys and “entertainment” instead of putting that cash towards a deposit and servicing a home loan.

Over the last few months all of the banks have tightened their loan servicing calculations meaning than you need more cash to service the same amount of debt as a few months prior. Credit cards and car loans are the # 1 killer of borrowing capacity. For example a simple $500 p/m car loan payment can knock over $100,000 off your borrowing capacity!!

Something to think about before signing the dotted line on a finance application for a depreciating asset.

I offer a free financial “health check” service for those interested in finding out how much a bank will lend them For more info email: [email protected].

Cheers

Ollie

Hi Ollie, thanks so much for the insight. Mortgage brokers are at the frontline of property investing and Im sure you see many and varied versions of savings plans. Credit and instant gratification is such a trap and those figures you mentioned are staggering! Well worth having a savings plan in place asap if people want to borrow money from banks that are increasingly becoming more stringent with their policies. Great feedback Ollie, thanks 🙂

HI Matt,

Thanks for sharing such a valuable resource, FOR FREE TOO!!!

It’s impossible to make money without knowing how much you are spending, taking the time to analyse where it is going, where you are potentially bleeding and where you are going well will only set you up personally for the future ahead. It’s a sad state of affairs when people spend more time picking what to watch on TV than sitting down and working out their finances.

There is no doubt anyone who wants to takes ownership and control of their finances and invests the time necessary will be the master of their domain and will really help them move forward.

Thanks again for sharing!

Justin

Hi Justin. Thanks for the comments and I love to see people just ‘get it’. A little bit of discipline goes a long way but we are all human and easy to be distracted from what’s important, especially when there is no immediate gratification. Great to see you using the cashflow planner and looking forward to seeing your property projects!

Hi Matt,

I love this stuff. I just regret not loving it more when I was younger. Just spending time tracking the ‘actual’ makes us conscious of what is going on (and therefore less likely to impulse buy) and it is no surprise when one of those horrendous bills come in.

I like how you simplify it down to spending less than you earn and creating a surplus as well as tracking savings. I recall reading the Richest Man in Babylon book when I was 19 and saying to myself I’m going to save 10% of my income for the rest of my life but it wasn’t until I turned 40 that I truly started that journey and it is one of the best decisions I’ve ever made. It opens up opportunity. Thanks for the blog Matt. Really great.

Simon

Hi Simon. Thanks so much for the feedback. Yes I agree, even if you dont use the budgeting tab in the spreadsheet and just track what you actually spend in a month, you gain more control over your finances simply from being aware. I was 33 when i read Richest Man in Babylon which is nearly 10 years ago and its changed my life. We always wished we started earlier but its never too late to begin – well done mate!

After having experienced the negative effects of bad credit card debt, I can honestly say I wish I had of come across this way earlier!!!

This will save people time, stress AND thousands of dollars….

Absolutely brilliant Matt, thanks so much for sharing this!

Thanks for the honest feedback Clayton and we’ve all been caught in the credit card trap before. I can remember in my early 20’s the bank ringing me up saying that i had exceeded my credit limit and would i like to add another $2000 to it? Not understanding how credit worked at the time i said ‘yes of course, you guys are so generous!’ Times have changed for me but It’s easy to see how people end up in the downward spiral. I really hope the cashflow planner saves a lot of people from the same fate. Thanks again Clayton 🙂

Thanks for the advice and sharing your free cash flow planner! I’ve been using my own spreadsheet to manage finances however the one you kindly shared is super simple to use and helps me track and plan more accurately. I’m a convert!

Thanks for the great feedback Ash and great to hear you already have a system in place to manage finances. I’m glad the Cashflow Planner has been able to enhance your existing process – great stuff!

Hi Matt

Thanks for sharing a super simple tool. So far, I was using one of my own, however, this one looks more cool and professional. I am looking forward to use this for myself and share with my friends too.

Love your work!

Matt, I have been searching for this type of advise for about 2 months now. This is great information and very easy to relate to. I love your budget spreadsheet (I have completed product development costing previously in the food industry and I had a very similar setup). Thank you so much for making all this so affordable (and without the hype), cause I am just not a hype type individual. I had collected as much free information as I could find and had decided in the last few days to set up my own flow chart and checklist. Now I don’t have to. Thank you for sharing your experience with me. I am loving this methodology. Kind regards,

Awesome to hear this info has helped you Gayle and great to hear you implementing these methods. I wish you the best of luck on your journey 🙂 Cheers, Matt

Thanks for sharing this Matt. Looks like a pretty easy tool to use and I like that the categories can be totally customised. We currently use Xero for our accounting but because we have different Xero entities (e.g. business, personal and super fund) it’s difficult to track our overall spending. One solution may be to export the balances from each Xero module into your spreadsheet each month. Not sure if this is possible but it would save double entry and enable us to see “the big picture”. Kind regards

Thanks Julia.. yep it’s just an Excel spreadsheet on steroids really 🙂 Great idea exporting the data from Xero. You may need to customise it a bit to make the cells line up. Use the word ‘congo’ if you need to unlock the spreadsheet. Good luck! Cheers, Matt