How to Make the Most of Your Financial Resources

Are you closer today to the goals that lead you into property investing to begin with?

I know how easy it is to get “Tunnel vision” and focus exclusively on finding your next deal. After all, you’ve got into property to make money and that’s where your profits come from, right?

But after flipping deal after deal – even with a consistent profit record – it doesn’t look like you are any closer to the life you envisioned when you first started.

If that’s your case, maybe this is the moment to take a step back, reassess your overall wealth creation strategy and design a financial plan that will take you where you really want to go.

I'm pulling back the curtain, revealing my best kept Deal Finding Secrets!

- My Secret Search Strategies: Unlock hidden cracker deals no one else knows about

- Stop wasting hours on research: Simple setup automatically hunts down hot deals for you!

- How to use Australia’s top research tool anytime to turning boring research into an exciting treasure hunt

- Bonus: Free Research Tool Credits Included!

🎯 Don’t miss this!

According to Jolene and Matt Sukkarieh, financial planning experts at My Financial Group, a wealth advisory firm in South-East Queensland, that’s where the advice of a qualified financial planner can help.

Unfortunately, many property investors don’t tap into the power of financial planning because they have misconceptions about what financial planners do, try to handle their finances themselves or simply are unaware that the resource is available.

If you are serious about building wealth in the property game, here are a few questions that you should be asking about financial planning:

What Does A Financial Planner Do?

A financial planner helps clients develop an overall wealth creation strategy by looking at their options and guiding them toward better financial decisions. Financial planners make sure that clients are empowered to make financial transactions and understand the implications regarding their finances.

According to Jolene…

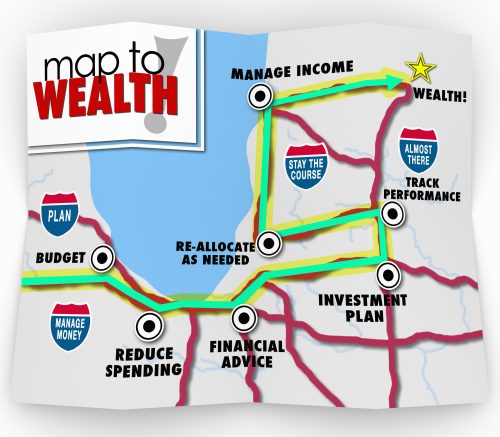

…through their process, they can help clients set wealth goals and create a map to measure their progress on an ongoing basis.“

For example, they may identify cash flow strategies that can help clients see a tangible outcome that improves their overall financial picture.

Most financial planners meet with their clients at least annually to check on how things are going with savings, earnings and debt. And, they keep clients apprised of any changes to rules and regulations that could affect their financial situation.

Many property investors mistakenly believe that hiring a financial planner will not benefit them if they don’t have money to invest in shares or managed funds. In fact, financial planning can benefit anyone who needs to develop an overall financial strategy.

The advice is more about outcomes and overall financial picture,” Jolene said. “It’s not so much about having money to invest in a financial product.”

How Can A Financial Planner Help Me Achieve My Financial And Property Investing Goals?

One of the biggest benefits of financial planning for property investors is that it helps them to anticipate and deal with financial issues at the start of a project, as opposed to being surprised and unprepared when things come up later.

We deal with things at the onset so the client doesn’t say, ‘I wish someone would have told me that at the start’,” Jolene said.

“Just like the ‘two-heads-is-better-than-one’ scenario, it’s about trying to factor in as many things as possible so you’re planning for it.”

Jolene explains that, contrary to popular belief, financial planning for property investors isn’t only about structuring investments or tax minimization; instead, it’s about considering the long-term implications of property projects by factoring in things such as costs, land tax, profit and depreciation.

Property investors are focused on making money, and we can help with that,” Jolene said.

Property investors also can be prone to recycling profit, which can be risky. A financial planner can make recommendations that will help property investors diversify as profits increase and they begin to build capital.

In case risks happen, you need other strategies so you don’t jeopardize your hard work,” says Jolene.

“We help you map out and manage your financial plan on an ongoing basis.”

And, because it can be easy for property investors to get emotionally wrapped up in their businesses and finances, it often is helpful to have a financial planner’s outside perspective.

A financial planner will be able to look at your financial picture objectively and give fact-based information and recommendations.

When Should I Consider Hiring A Financial Planner?

Although Jolene said that many clients come to My Financial Group when they are frustrated with their financial situation, there is never a bad time to seek financial advice.

Jolene points out that, in most cases, they can suggest a few simple things to implement during an initial client meeting.

Financial planning can be especially useful for people who are nearing retirement age. According to Jolene, clients’ expectations are often different from their financial realities, so having an early understanding of their financial picture can help to prevent financial shock.

What Should I Look For In A Financial Planner?

Financial planning is a constantly changing industry, so you need to be sure that your financial planner is up to speed on the latest rules and regulations related to taxes, insurance, investing and other areas that may affect your finances.

It also helps if your financial planner has some experience working with property investors—or has personal property investing experience.

For example, in addition to being financial planners, Jolene and Matt also are property investors. Since purchasing their first property in Brisbane, Jolene and Matt have completed multiple developments and blocks of units, picking up valuable knowledge and experience as they went.

Our exposure to property investing and awareness of all the issues from personal experience enables us to enhance the advice that we give,” Jolene said.

You also should be sure that your financial planner is committed to explaining things in a way that you can understand and has your best interest in mind.

For a FREE financial health check on your current position, give Matt and Jolene a call on 1300 634 000 or email them at [email protected]

No obligation, no shenanigans, just an honest overview of where you are now and where you should be heading to achieve financial freedom.

Because a financial planner is such an important part of building wealth, you can’t have just anyone on your team. To help you find the expert advice you need, Property Resource Shop’s Property Investor Rolodex will reduce the guesswork by providing you with a list of tried-and-tested professionals in your area.

Looking for proven ways to create profits in the current market?

You'll find over 200 step-by-step case project studies, our renown Master Classes and Property Crash Courses… and heaps more!

Try the Ultimate Property Hub now –– it's free!

0 thoughts on "How to Make the Most of Your Financial Resources"