From ‘A’ To ‘Profit’: How To Structure Joint Venture Deals With Confidence

If you’ve been reading Part 1: Here’s An Easy Way To Fund Your Next Deal and Part 2: Three Types Of Partnerships That Are Making Australians Rich – Which One Fits You Best? you are now fully equipped to start tapping into the easy profits that are waiting for you.

In this post, I’m going to show you why most investors are focusing on the wrong deals. This makes them waste a lot of time and a considerable amount of money – but their loss is your gain!

In this post, I’m going to connect the dots so by the time you’re done reading you’ll have a very good blueprint for putting together your next (or first) joint venture.

But first, let me explain why I think most of your competition is chasing the wrong deals… leaving the best ones wide open for you:

The Perfect Deal Syndrome

I see a whole heap of property investors waiting for the perfect deal, at the perfect time, with the perfect partner… well guess what? There’s no such thing as a perfect deal.

Of course, it’s great to have an abundant mindset that attracts quality deals. But think about it – if a deal is perfect… doesn’t that mean there is no further value you can add? And if it’s so perfect you can’t add value to it… then you won’t be able to extract any profit from it!

And that’s not good—unless you are just happy to buy and hold and hope that the market goes up (which sounds a lot like gambling, in my opinion).

Here’s how I see it:

The More Imperfect The Deal, The More Opportunity For You To Get Paid!

The more imperfect the deal, the more opportunity there is for you to solve problems and add value.

Just because you can’t find the perfect deal doesn’t mean you can’t take the perfect approach. When you put a deal together, you want to make sure you are aiming for the perfect outcome—to create profit.

A People Business

You’ve probably already figured out that property investing is a people business, which is why you need to communicate very clearly when putting joint ventures together.

I think the biggest fear of property investors who are considering joint ventures is potential conflict caused by lack of communication.

There’s a very negative thought process around conflict that goes something like this:

What happens if I get into a joint venture and I don’t get along with the partner, the deal goes sour, we lose money, we start blaming each other, we end up in court and go broke because of our legal bills?”

This negative thought process doesn’t serve anyone; it just instills fear that paralyzes property investors and prevents them from moving forward.

Having said that, you do need conflict resolution clauses in your JV agreement. But the best way to deal with conflict is to not have any in the first place.

Structure to Avoid Conflict

When I see a joint venture go bad, it is usually because there is little or no structure set up.

When the partners don’t know what is expected of them, it leads to confusion, blame, resentment and eventually, conflict.

You can prevent conflict by having really good communication and setting up clearly defined roles and responsibilities so everyone knows what is expected of them. By doing this, you are effectively setting up your own informal JV agreement that you can take to the solicitor to formalize.

The more effort you put into developing roles and responsibilities—and the more clarity you have in your own informal agreement—the better you can articulate your wishes to the solicitor.

This will save you a stack of dollars in legal costs in the long run.

The best way to do this is to use my Roles and Responsibilities Checklist which you’ll find in the Ultimate Property Hub

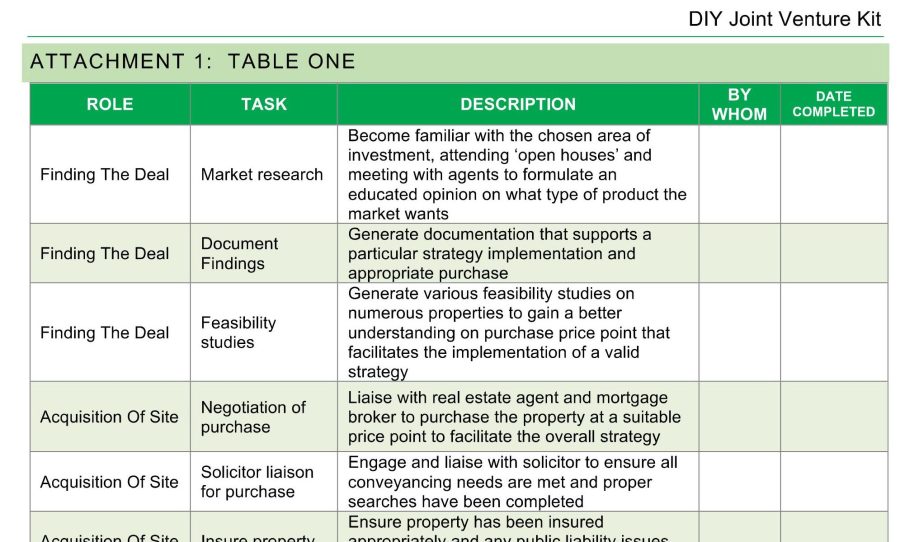

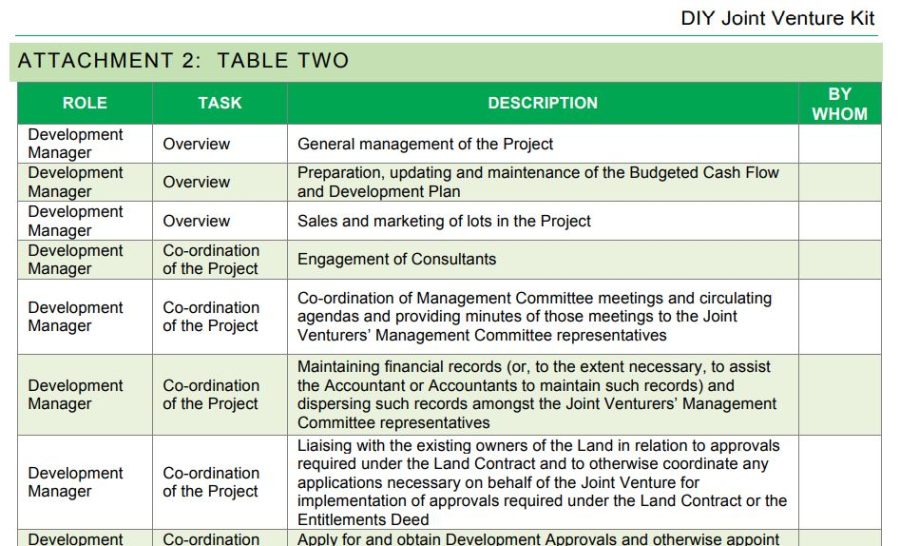

On Pages 4 and 5 of the checklist, you will see that the allocation of roles is broken into two tables.

Page 4 presents the broad scope of roles and responsibilities table (see image below). It is a good idea to go over each role with your joint venture partner early in the process to get a good understanding of where the venture is heading.

Page 5 provides a table that focuses on the deal specific scope of roles and responsibilities (see image below). All of these tasks might not be applicable to your particular project, but it is a good idea to go through this list to determine if any tasks need to be outsourced.

After going through these tables, you should have a clear idea of who is doing what on the project—and the makings of your own joint venture agreement. You should also have an idea of how the profits should be split based on the allocation of responsibilities.

Getting Down To Business: Who Gets What In Your Partnership?

Let’s look at a few common scenarios to help you get your head around how profits and responsibilities can be shared:

Scenario 1 – 50/50 Time & Money Contribution

This is a basic scenario where two investors split the profits evenly and provide complementary skills and resources.

Kate showed up to the Property Launchpad with no experience. Now she's set to make $100k in the next 12 months!

Want to do the same? Apply now!

Property Launchpad - your ticket into the highly-profitable world of Joint Ventures!

Jane:

- Has a full time job, good wage and good servicing;

- Has $50,000 saved.

Josh:

- Has a part time job, no real wage to leverage off but has time available;

- Has saved $25,000 and borrowed $25,000 from Dad.

Both of them have limited practical knowledge but have 12 months of theory based education and decide to setup a JV agreement.

- Jane’s accountant sets up a company and trust structure with Jane as the sole director because Josh’s low wages would probably weaken the mortgage application with the bank.

- They look for a renovation opportunity where they can buy, complete a cosmetic renovation and sell and split the profit;

- Jane borrows the money and both investors provide $50,000 each to create $100,000 in capital available;

- Josh becomes the project manager of the renovation;

- They engage a lawyer to endorse the above points in a formal joint venture agreement;

- Josh and Jane have become area experts and after much research have stumbled across the ideal property;

- They negotiate a discounted purchase price of $300,000;

- Jane borrows 90% of the purchase price from the bank ($270,000) while their $100,000 goes towards the deposit and project costs;

- Josh completes the renovation and they sell back to the market for $450,000. After costs they bank $40,000 and split 50/50;

- The JV went well and Josh and Jane decide to repeat the process to build their capital base in order to leverage into bigger projects.

Scenario 2 – 50/50 Time & Money Contribution Plus a Money Partner

Building on Scenario 1, Josh and Jane decided to take on a larger, more profitable project. But, in order to preserve their capital, they decide to take on a money partner.

- Josh and Jane have now completed a few renovations and built up some capital and want to do more deals at once by using a money partner;

- They also leverage their time by engaging a buyer’s agent to find them the next development site;

- They have the JV agreement adjusted but keep profit share the same at 50/50;

- A colleague finds them a small subdivision site which they acquire and pay the colleague 2% ($10,000) of the purchase price being $500,000;

- the bank lends Jane 80% of the purchase price ($400,000);

- They need a further $200,000 to pay for:

- The 20% deposit ($100,000);

- Purchase costs including stamp duty ($20,000);

- Subdivision costs ($65,000);

- Holding costs ($15,000).

- Josh finds a money partner that is willing to contribute $225,000 and agree to pay 12% per annum for 8 months, totaling $18,000;

- Security is provided to the money partner by way of a registered mortgage over the property.

- A lawyer is engaged to draw up the agreement including these terms.

Because Josh and Jane have assembled a fantastic team of consultants, they complete the subdivision in six months and sell the first lot only one month after completion.

Proceeds of the first sale are used to pay back Jack’s principal and interest before the mortgage because Jack negotiated a higher interest rate than the bank.

Although Josh and Jane are paying Jack back a month early and owe a lesser amount of interest, they decide to pay Jack the full return of $18,000 to thank him for his good faith. Because of Josh and Jane’s generosity, Jack wants to invest in their next project.

Josh and Jane complete the sale process and split the proceeds 50/50.

What This All Means For You

When you are setting up JV agreements, it is critical for each party to seek their own legal counsel regarding the joint venture documentation. For $2,000-$3,000, you will receive peace of mind and mitigate a huge amount of risk.

No joint venture should be done on a handshake—a JV agreement is the best insurance policy you will ever create.

Where To Find The High Quality Property Partners You Need

As I keep saying in this blog series – there’s so much opportunity out there for investors who are ready to take the plunge and start doing deals that really matter.

After all – you didn’t choose a property career because you enjoy haggling with mortgage brokers and doing small-to-medium renovations and subdivisions, wondering when a good deal will fall into your lap. Right?

Remember Why You Got In This Game

You got into property because you want the peace of mind that only financial security can give you, and because you know there’s no other way to achieve it (no one ever got rich from their 9-to-5 after all).

You’ve worked hard. You deserve the leisure, enhanced quality of life, and most important – sense of pride – that reaching the next level will give you.

Trust me – it’s an amazing sense of accomplishment and triumph. It’ll make you feel like king-kong. And I want you to share that experience.

I also want to fast-track the “getting there” part for you because…

There’s No Reason You Can’t Put All This Lazy Money To Work Right Now!

But I understand most people don’t know how to go around finding joint venture partners. It can be hard and incredibly time consuming to do it on your own. That’s why I’ve created the Property Investing Partners Academy.

The Property Investing Partners Academy is a private, invite-only club. Members are pre-qualified, committed property investors who have the resources that are missing from your property investing strategy.

When you join the Property Investing Partners Academy, you can wave the days of doing deals with random people goodbye. You rid yourself of any uncertainty about the JV process.

This Is The Shortcut You’ve Been Waiting For

This is your chance.

If you’re serious about surrounding yourself with the right people and about growing your property business in leaps and bounds this year – this will be perfect for you.

Applications are about to open, so if this interests you make sure to click here now. Doors will be open only for a short while and spots will fill up quickly.

We will accept no more than 30 new members at this time, and have no problem accepting less if applicants aren’t up to par. As I said – this is the crème de la crème. The crown jewel.

This limited opportunity will not be repeated again this year. If you are ready to fast-track your wealth creation and meet the investors who can save you from years of working your way up alone… then I encourage you to click here now.

But Don’t Delay! Doors Are About To Close On This Opportunity

I look forward to receiving your application soon. Don’t wait or you will regret missing out. If you want to create permanent wealth through property – there is no better way.

Apply now to become part of the next 3 Day Joint Venture Bootcamp

To your fast success,

Matt Jones.

Hi, great article and investment tips. Thanks.

One question on the Scenario 1 – 50/50 Time & Money Contribution.

You mentioned Jane’s accountant sets up a company and trust structure with Jane as the sole director….

1) Did you mean set up a company then a trust under the company?

2) Why set up both company and trust structure and why not one or the other?

Anney.

Hi Anney,

Thanks for your comment. In answer to your questions…

1) Yes, in this particular scenario I do mean that the company is set up inside the trust; and

2) There are many complex scenarios when it comes to which structures suit each individual, and this is really a question you will need to discuss with your accountant to find which works best for your situation.

Paul Copeland from William Buck would be more than happy to answer your questions, if you’d like to pop him an email; he specialises in property investing structures: [email protected].

Cheers,

Matt

Thanks for clarifying.